Residential energy efficient property credit is available through 2021 and congress looks ready to extend some energy credits that expired in 2017.

Energy efficient water heater tax credit 2018.

The tax credit is for 300.

300 requirements uniform energy factor uef 0 82 or a thermal efficiency of at least 90.

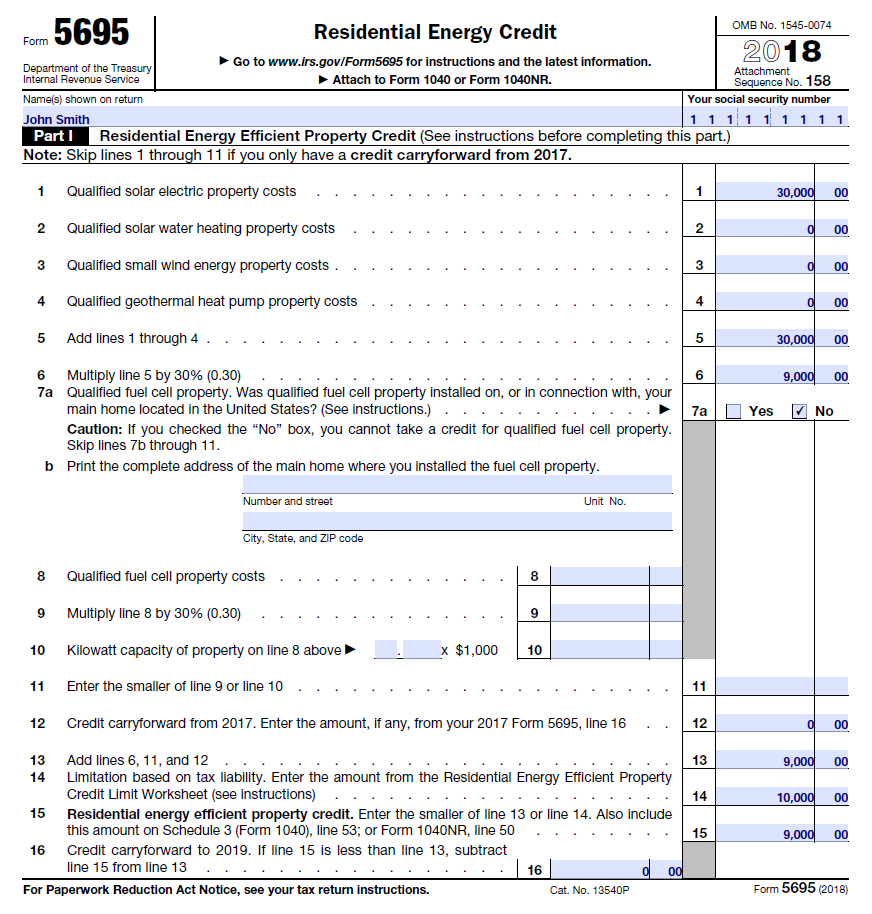

Qualified equipment includes solar hot water heaters solar electric equipment wind turbines and fuel cell property.

Gas oil propane water heater.

The tax credit is for 50.

12 31 2017 through 12 31 2020.

Qualifying water heaters include gas oil and propane units with an energy factor overall efficiency of 0 82 or more or a thermal efficiency of at least 90 percent.

Residential energy efficient property credit.

Certain energy star certified gas water heaters meet the requirements for this tax credit.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

These popular residential energy tax credits equal 10 of the cost of product to 500 or a specific amount from 50 300 for the following eligible items.

Residential electric heat.

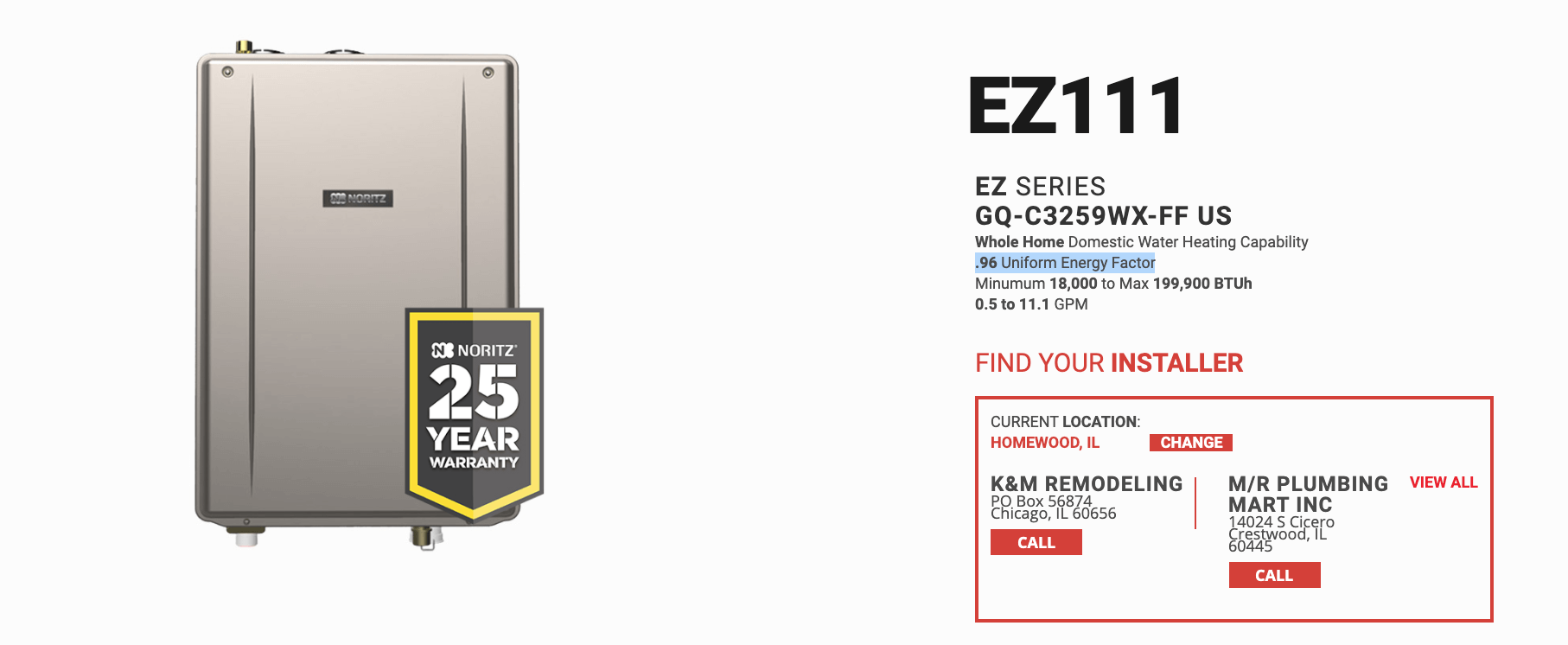

Uniform energy factor uef 0 82.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

Claim the credits by filing form 5695 with your tax return.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Federal income tax credits and other incentives for energy efficiency.

So if you re thinking about installing solar power a solar water heater a geothermal unit or fuel cells now is probably a good time to act.

There s no dollar limit on the credit for most types of property although the credit for fuel cells is capped at 500 per half kilowatt of power capacity.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Solar hot water heaters solar electric equipment wind turbines and fuel cell property are examples of equipment eligible for the tax credit.

Residential gas oil propane water heater.

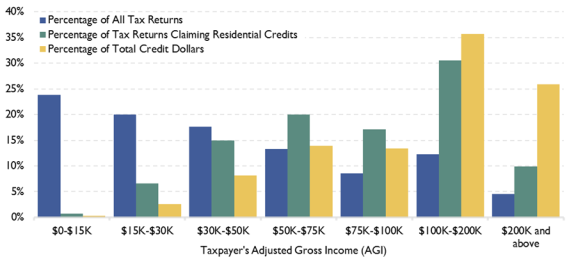

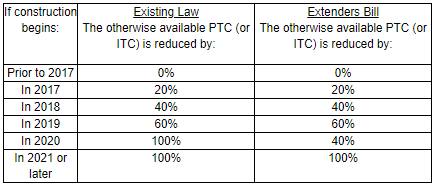

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

Water heaters account for 12 of the energy consumed in your home.

Residential water heaters or commercial water heaters and select yes for tax credit eligible under advanced search.