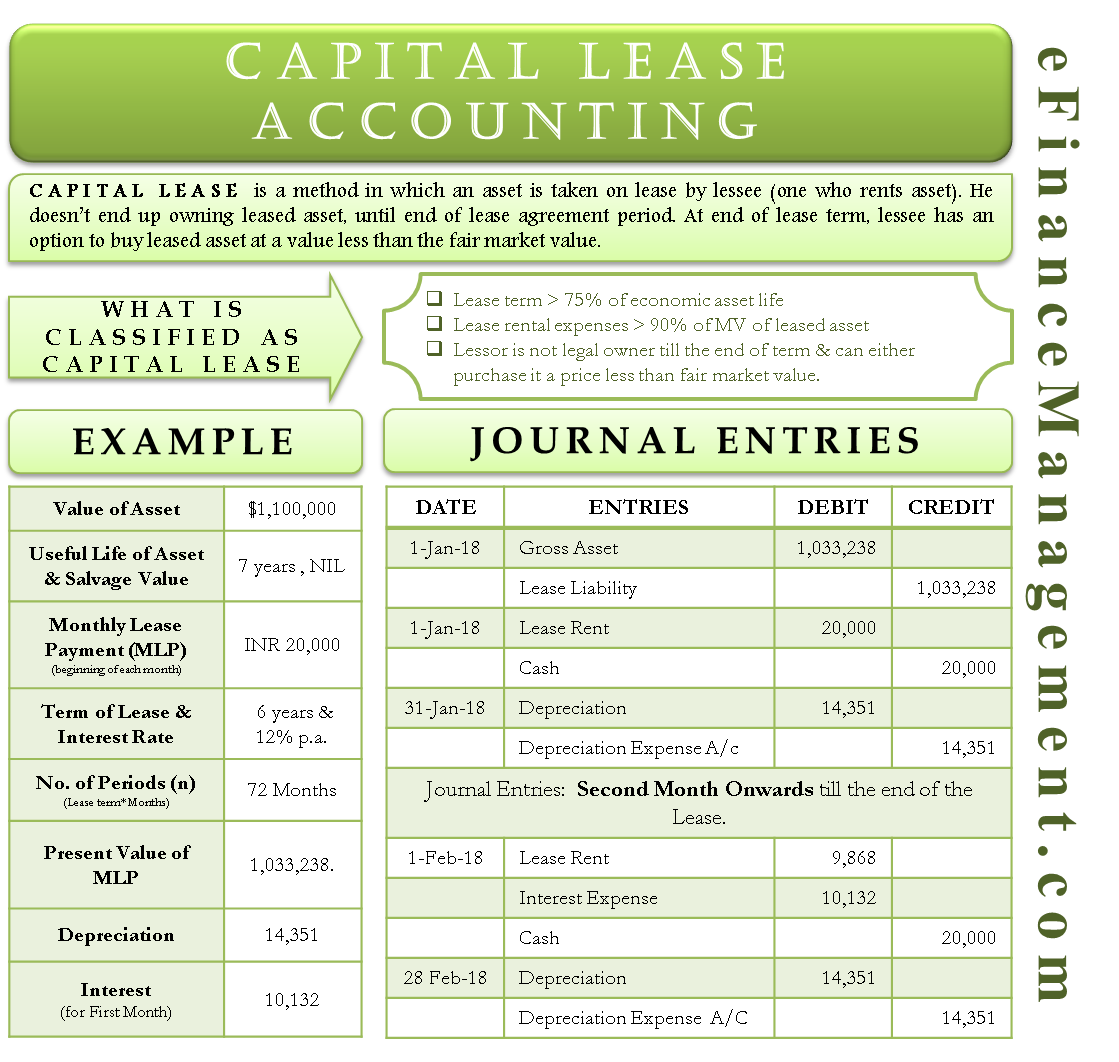

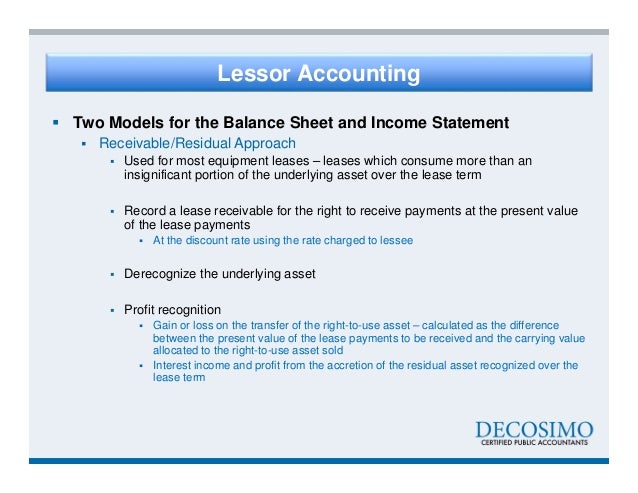

Well in every lease whether it be a 3 000 000 piece of manufacturing equipment or a 20 000 car there is an implicit interest rate that lessees pay to lessors.

Equipment lease interest rate formula.

Also gain some knowledge about leasing experiment with other financial calculators or explore hundreds of calculators addressing other topics such as math fitness health and many more.

Table of contents implicit interest rate meaning and definition.

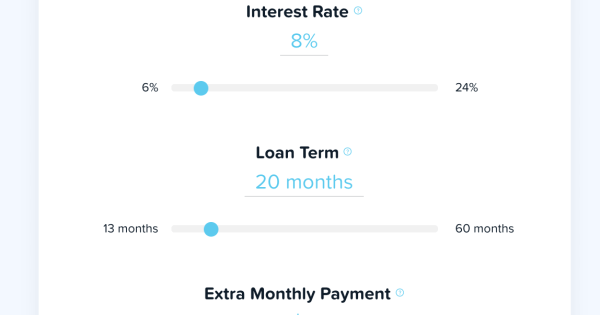

To calculate your approximate monthly payments simply fill in the calculator fields equipment cost lease type lease term interest rate and click on calculate.

Some equipment financiers offer payment calculators online to help you estimate the total cost of an equipment lease.

Free lease calculator to find the monthly payment or effective interest rate as well as interest cost of a lease.

Equipment priced less than 100 000 usually comes with a higher finance rate anywhere from 8 to 20.

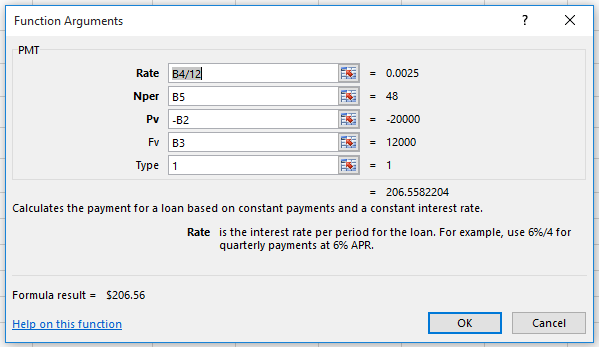

The lease term expressed as months must a multiple of 3 with quarterly payment frequency 6 with semiannual payment frequency and 12 with annual payment frequency.

Larger more expensive equipment can generally be leased with a financing rate of 6 to 8.

When you lease equipment the lessor is effectively putting up a lump sum of money on your behalf which you will pay off with interest over time.

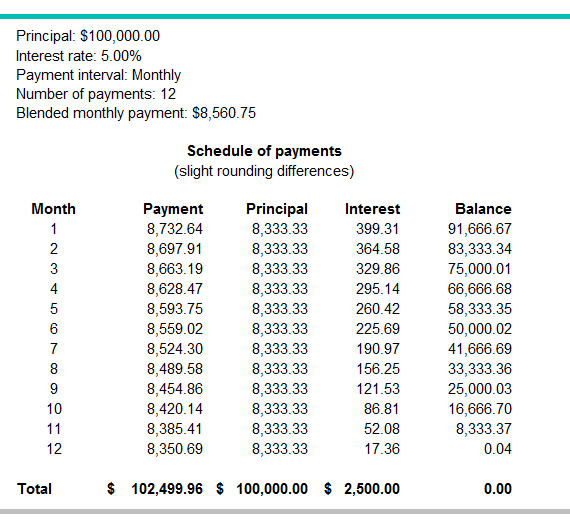

The primary reason that leasing generally yields lower monthly payments is that although you are still paying the interest based on the full amount of the loan the capital parts of the payments only have to add up to the difference between the loan and the residual value with r r 1200 the following formula calculates the monthly payment and can be reduced to the loan calculator formula.

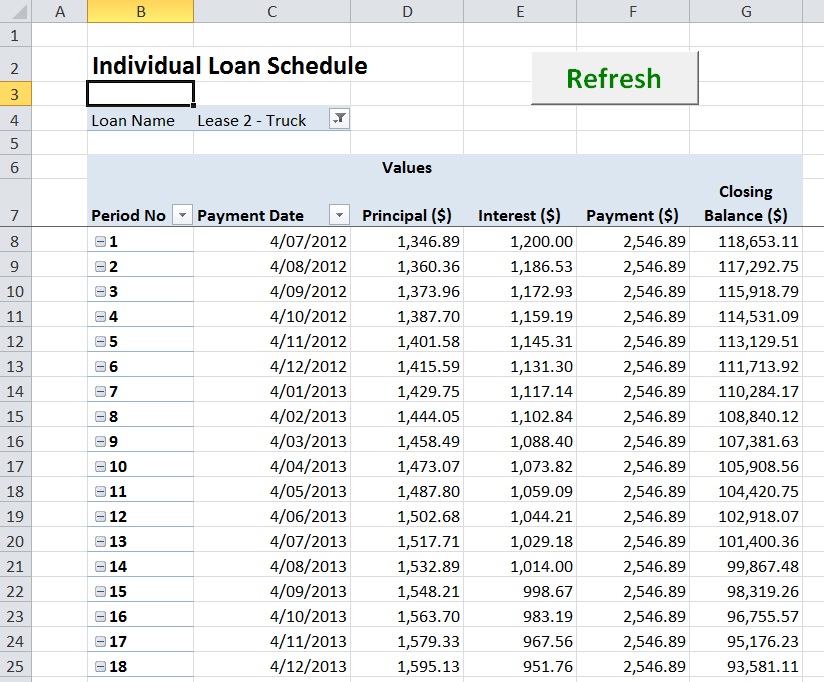

The lease will be for a period of 36 months and charged an annual interest rate of 6.

The lease rate factor is the annual interest rate divided by the number of monthly payments.

The company is financing 19 000 and will make annual payments of 6 000 for four years.

The compounding frequency is set to the selected payment frequency.

If the current interest rate is 6 percent then the lease rate factor in our example is 0 06 60 or 0 0010.

John managed to negotiate the selling price to be 26 000 with a down payment of 4 000 and an outstanding loan balance of 5 000.

Your lease payments may increase or decrease as a result of applicable credit reviews conducted by the lessor.

Your lease rate is 9 078.

The effective interest rate on a lease can be anywhere from the low single digits to more than 30 with the average is around 6 to16.

:max_bytes(150000):strip_icc()/df910d172afe46eee2b0caacceebd965-cb4b9c4b6e4a492ebe6355f22072d816.jpg)

/GettyImages-552980487-56a0a5f33df78cafdaa3928e.jpg)